What is the problem?

Buying offline is usually 10-20% more expensive, and insurance is no exception. For example, if a person applies for a paper form to the insurer's office, they should be prepared to overpay 10% of the commission to the agent who draws up and prints the contract. If the mandatory vehicle insurance costs 1,000 hryvnias, about 100 hryvnias will go to the IC employee. But in fact, each of us can do this on our own. All you need is to pick up a smartphone.

"The biggest insurance mistake is to buy a policy at random, blindly trusting an insurance company employee. Because their main goal is to sell. We're sure that the lion's share of 63% of drivers who applied to an agent last year don't even suspect the weakness of their insurance protection," says Kateryna Andriiva, a specialist in hotline.finance online insurance service. "Besides, ignoring the online policy, whether car insurance, travel insurance, or something else, Ukrainians deprive themselves of the opportunity to save up to 40%."

What is the solution?

The best solution is to abandon the paper form and trips to the insurer's office now. No need to waste time on this anymore. Instead, hotline.finance offers a convenient service for comparing and registering insurance products online. The process is as simple and clear as possible:

- you choose the type of product

- you compare offers from top insurers

- you enter the requested data

- you pay for the policy

- you receive ready insurance by email

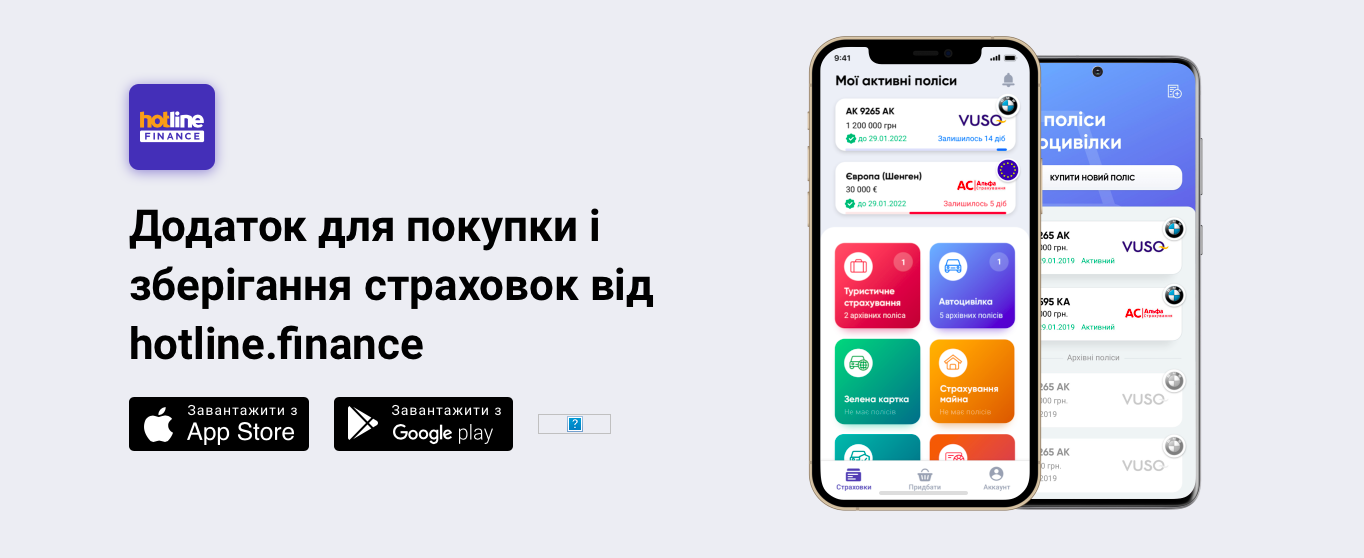

You can save the contract both in email and on the hotline.finance mobile application or in the GPay wallet. Insurance can be used at any time as easily as paying with a card at the cashier.

The following insurance products are available on the service:

- Mandatory vehicle insurance

- Additional insurance coverage to mandatory vehicle insurance

- Travel insurance for traveling abroad

- Home insurance contract

- Medical insurance for the driver

- Green card with free shipping

- Insurance for traveling for work abroad

They also launched the sale of Comprehensive Cover with 10% cashback. Since this type of insurance isn't yet available in electronic format, customers can order it on the website under a simplified mechanism with a bonus.

How does it work?

We reveal online insurance mechanisms

Before buying, especially something new, several questions arise. So that users have no doubts about, hotline.finance experts answered the most "burning" questions.

- What if an insurance company has already changed the terms of the contract, and the information in the hotline.finance directory hasn't been updated. Does it happen?

As a rule, the parameters of insurance products are unified and often regulated by law. Therefore, you'll find accurate data on the website. However, the insurance companies themselves are interested in the relevance of the information displayed in the catalog, as it affects the level of sales. The service receives prices directly from the insurance company.

- Does hotline.finance check insurance companies for safety? What if we buy insurance from a scammer?

We integrate with trusted companies that are licensed to perform a specific activity. There aren't so many insurers in Ukraine, and information about them is publicly available. In addition, we display feedback on the work of companies. That is, you can see the rating of the IC from other customers and decide whether to enter into an agreement with this partner.

- Why don't I have to come to the office to get insurance?

The very name "e-insurance" has the key to the answer: you can buy without having to go to the office of the insurance company. It means you can do it simply, without queues, without papers, which we don't like too much. The purchase process is automated from the selection of the program to its receipt by the customer. It doesn't matter where the person is. All you need to receive the service is a device, wi-fi, and a bank card to pay.

- Does hotline.finance act as an intermediary in this case?

Do you remember the new-fangled word "marketplace"? So, hotline.finance is that. Only for selection and registration of insurance products online.

Will it work?

Why you shouldn't be afraid of online insurance

- It's cheaper to take out insurance through hotline.finance. How does the service earn?

Hotline.finance has profitable partnerships with insurance companies that want to be available in electronic format. Don't forget about the absence of the commission of the insurance agent; it's 10%. We often hold raffles, give promo codes at a discount, and launch sales. Thus, we draw the client's attention to e-insurance.

- Is online insurance enough? Can't they demand a rubber stamp somewhere?

Rubber stamps are relics of the past, not only for the insurance market. But, if we talk about it, we should note that each contract has an individual number, which is stored in the IC database. In the case of mandatory vehicle insurance, this number is fixed in the public database of the Motor Transport Insurance Bureau of Ukraine, and the policy itself is pulled up to the Diia state application.

- Can hotline.finance help customers get a refund on their policy?

It may. In general, few people know that the client has the right to terminate the contract with the insurance company and return the money to the account. For our part, we make every effort to ensure that a person receives money on request without a headache, if, for example, their trip is canceled. Hotline.finance has Ukrainian customer support in the best traditions!

Hotline.finance has helped to select and register online more than 300 thousand financial and insurance products.

Even if you're not a fan of electronic document management and you are already tired of conferences in Zoom, e-insurance will suit you. After all, you're unlikely to be able to get together, leave the house, go to the nearest branch of the insurance company and buy a policy there in 5 minutes, even if the office is on the ground floor of your house. It's time to admit that the document folder is much more convenient if you store it on your phone.

Newsletter

Digest of the most interesting news: just about the main thing