What is the problem?

The September Financial Literacy survey by the National Bank of Ukraine and the UNICEF U-Report project showed that, on a five-point scale, young people aged 14 to 34 rated their awareness of financial issues at three points (43% of respondents). Experts explain this assessment by three factors:

- Families avoid the topic of money.

- At school, financial literacy is not yet a mandatory discipline. However, 65.2% of respondents say that it is necessary to teach students financial literacy.

- Due to their young age, people have little or no experience in financial literacy.

A significant percentage of respondents are inclined to believe that financial literacy should be taught in schools. Precisely, in 2025-2026, the Ministry of Education and Science of Ukraine plans to introduce a new compulsory subject, Entrepreneurship, and financial literacy, for grades eight and nine students. But until it is implemented, young people still need knowledge about the distribution of funds and an understanding of such concepts as credit, capital, taxes, earnings, investments, deposits, etc.

Parents cannot always deal with this and explain these processes verbally to their children. Moreover, simply listening to lectures for teenagers may not be as interesting as learning how to use money in real life. Therefore, teaching financial literacy should combine easy-to-understand theory and life examples.

What is the problem?

Learn how to allocate funds in a game form

For five years now, schoolchildren have been taught how to spend and invest money rationally in the game Life Capital in financial literacy clubs in various regions of Ukraine. Thanks to the non-governmental organization Partner Business Club, they have been opened in gymnasiums and lyceums.

Since 2018, more than 170 financial literacy clubs have been opened. It is quite difficult to name the exact number of those currently working because the number fluctuates due to military operations. "Some clubs are closing, and some, on the contrary, are opening," says Iryna Kovalenko, vice president of the Partner Business Club.

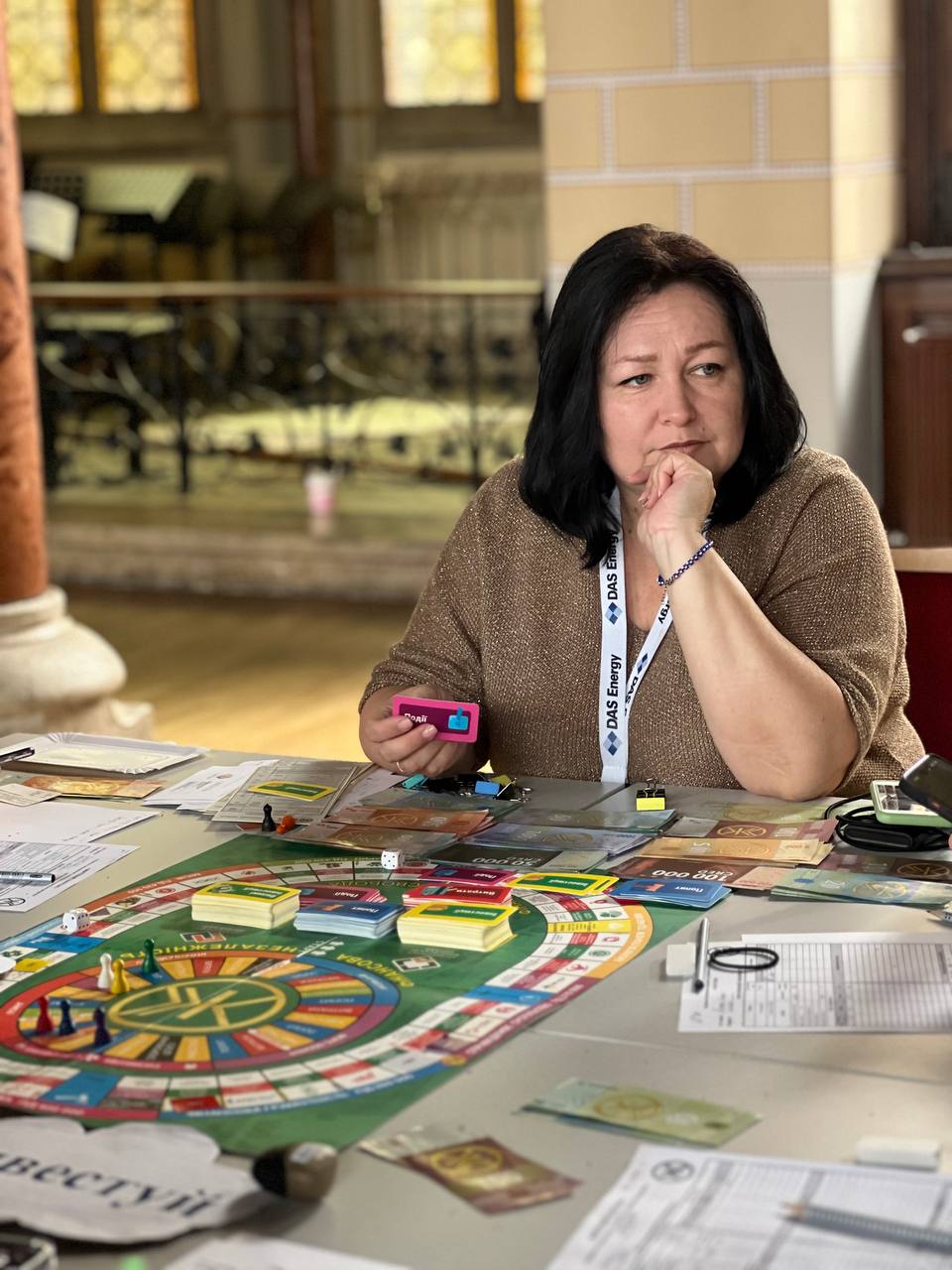

Iryna Kovalenko, Vice President of Partner. Photo from open sources

She adds that before the start of the full-scale invasion, financial literacy clubs were opened in almost all regions of Ukraine, except for Crimea, which was occupied by the Russian military in 2014. The largest number of such centers are located in the Kharkiv region — more than 30 clubs, as well as in the Dnipropetrovsk and Odesa regions.

"The main idea is to create clubs in educational institutions, as a center where basic financial education will be spread and, in accordance with it, entrepreneurship skills will be formed, further contributing to the development of a social enterprise. Financially literate children are the foundation of the future of Ukraine," Kovalenko emphasizes.

Financial clubs use the game Life Capital, developed by the authors of Partner. It is intended for children aged 12 and over and lasts about four hours. In the game life, the participant begins their activity at 25 and lives ten years in one hour. Accordingly, the game covers the working age of Ukrainians. The player finds themselves in various situations that allow them to learn how to use funds rationally, save them, and multiply them. The game also helps to analyze the main financial mistakes that the player makes.

How does it work?

Participation in the Life Capital game is free for students, and the teacher receives a salary for the hours counted within the elective or extra-curricular activity. Participants either play in the shelter or go there in case of danger.

Kovalenko is the vice-president of Partner, as well as a teacher of geography, economics, and financial literacy at one of Kryvyi Rih schools, where she opened a financial literacy club. It became the first in Kryvyi Rih to hold Life Capital games for students, parents, and teachers.

"I came up with the idea of opening a financial literacy club in 2020, but then the COVID-19 pandemic began. It was possible to open it on April 7, 2021. Despite this, we opened the club a year later, and it has been functioning through all these difficult years," Kovalenko shares.

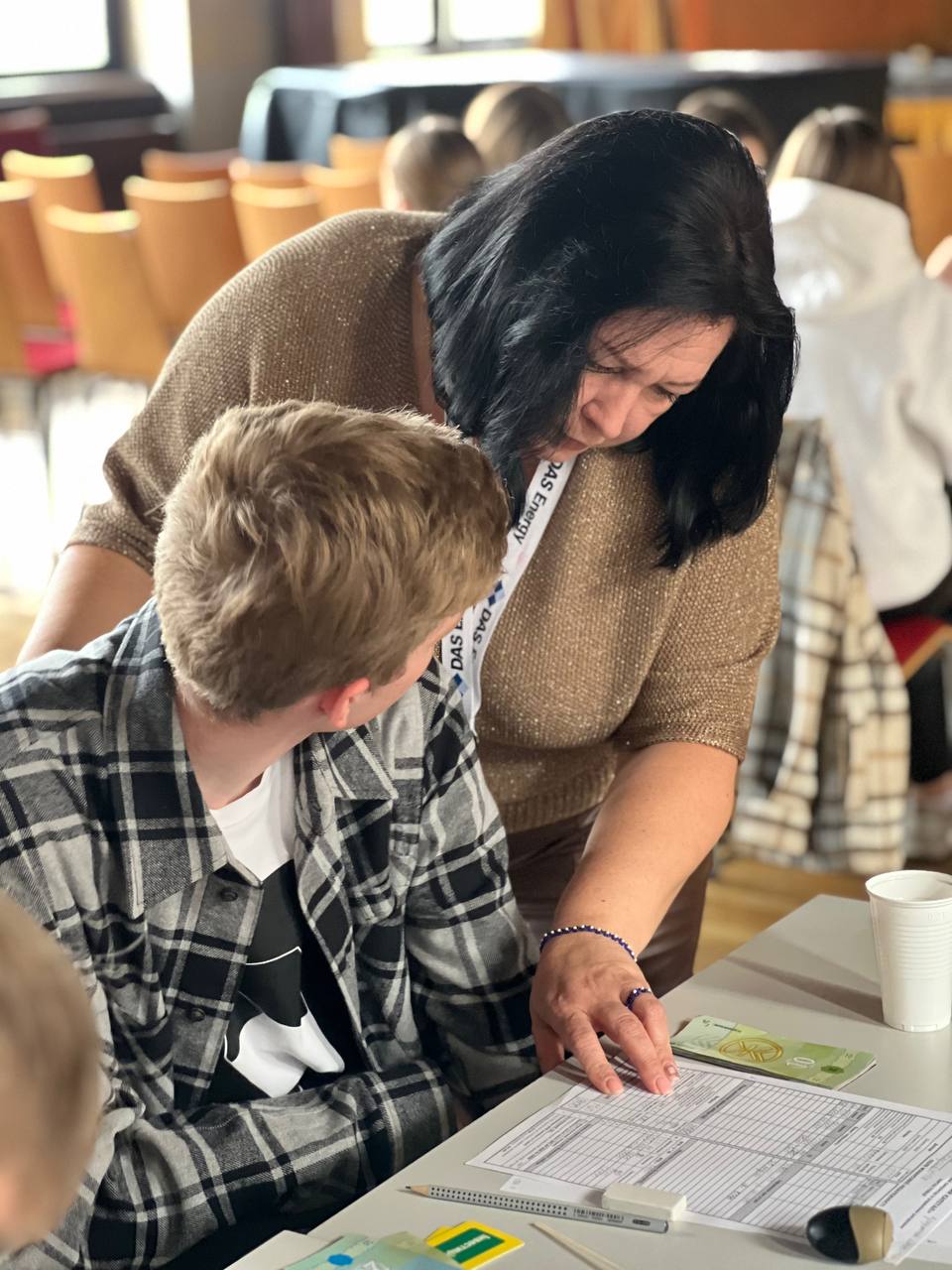

Iryna Kovalenko with teenagers playing Life Capital. Photo from the network

Students over the age of 12 usually attend the game. Children as young as ten can join, but it can be difficult for them, as individual age characteristics play a role here, Kovalenko emphasizes. The game is designed for eight players, but the optimal number for a dynamic game should be six.

"When eight inexperienced players participate, the game drags on. The first player usually gets bored and can't wait to go again. Six players is a better option," explains Kovalenko.

Game Life capital. Photo from open sources.

At the beginning of the game, each child receives their story, where their profession, the presence and number of children, and the amount of earnings, credits, loans, and expenses are recorded. Life capital has a game currency — credo — which is needed for financial operations that consider the Ukrainian economy's peculiarities. Members can buy real estate and businesses, save and invest, and face birthdays, layoffs, inflation, and more.

"In addition to the fact that students develop entrepreneurial skills, they also strengthen their mathematical knowledge. I require my children to count within a thousand verbally or in a column as needed. The main thing is that they shouldn't use a calculator. They learn a lot in the game —for example, percentages often need to be calculated," says Kovalenko.

In addition to developing math skills and financial literacy, children find themselves in various life circumstances where they have to face difficult choices in favor of something that adults often do. Students learn about humanity and interaction with other players.

Playing Life capital. Photo from the network

Kovalenko recalls that the presence of children from the start caused different reactions among schoolchildren. Someone could have several at once, and someone "gave birth" during the game. Some shouted that they did not want to have children at all. But even those who could be against them changed their opinion during the game.

"I was worried by such a negative reaction to the presence of children. There was a case when the girl also categorically did not want to have them. Once, two hours into the game, one of the boys had to go home because his mother called him. And this girl became so worried that he would abandon her three children that she eventually just adopted them. The game changes the way of thinking radically," recalls the game founder.

She is convinced that such a game prepares conscious and financially literate children for adulthood. They will build and develop Ukraine in the future with a clear understanding of the best ways and practices.

Schoolchildren in the financial literacy club. Photo from open sources.

The game gives birth to future entrepreneurs

Children begin to implement the knowledge and skills acquired in the game in practice. In particular, two students were interested in creating bracelets and drawings. As Kovalenko explains, they don't just create and donate them but already calculate their value to have funds for materials to create new ones.

In addition, the school financial club contributed to the emergence of the family project Ginger and Honey Story, where mom and seventh-grader Potap bake gingerbread for donations. They direct the funds collected from sales to help the military.

An idea that was born in the family but combined the project and the school. The club initiates auctions and sales where they sell gingerbread. Funds from them are sent to the urgent needs of Ukrainian soldiers. "Our school cooperates with various military units and local police," Kovalenko emphasizes.

Potap is receiving the award. Photo from open sources

Potap's mother is an individual entrepreneur, so all project activities are legal. The seventh-grader himself became a financial blogger and received an award at the contest of young bloggers "Talking about Ukraine" and the award Future.

"This is an example of how a social enterprise is born," emphasizes the vice-president of Partner.

Financial literacy abroad

As Kovalenko explains, financial literacy in the USA is embedded in the school curriculum, while in Ukraine, it is currently being actively developed. Therefore, the game Life Capital is a tool that provides basic knowledge to a child. However, the popular game Cash Flow is already designed for financially literate participants learning more complex processes, such as investing.

Take a 14-year-old child and say you will teach them how to invest. Now, let's learn about bitcoins and military bonds and invest in stocks, businesses, land, etc. But how can you learn to drive a car at high speed if you have not been taught how to start a car? "When kids sit down and play Cash Flow, I'm not saying it's bad, but it hurts the understanding and proper perception of how the financial system works. For this, you need a basic tool — Life Capital. It is focused on teaching the budget, how it is distributed, and how funds move," the expert explains.

Although Life Capital and Cash Flow have a somewhat similar game circle model, developed by the American businessman Robert Kiyosaki, the purpose of these two games is different. The first provides essential and basic knowledge, and the second already strengthens and develops it.

Despite the high popularity of the American game, Life Capital is also becoming famous abroad. Due to the full-scale war, some of the coaches left for foreign countries, where they now hold games for Ukrainian and local children. In particular, Ukrainian Sabbath School students in Vienna and Canada can play Life Capital with trainer Olha Yalovenko.

Olha Yalovenko speaks English and has the necessary certificates for work. In Canada, she received the status of a financial advisor and can provide services in Ukrainian and English. She also conducts games in two languages. She teaches English to Ukrainian children and Ukrainian to the locals.

Olha Yalovenko conducts a game in Canada. Photo from open sources.

Financial literacy clubs are planned to be developed abroad — in Croatia, Greece, Switzerland, Slovakia, Germany and Poland. Life Capital is going to be translated into different languages. In Ukraine, they will also continue to build a network of financial clubs where schoolchildren will be taught. Therefore, teachers interested in the game and children's financial literacy can contact the Partner Business Club, whose mentors will explain the procedure for opening the club and conduct appropriate training.