One recent WHO report on anti-tobacco measures in various countries states that increasing the cost of tobacco products is one of the most effective ways to reduce the prevalence of smoking. This works well in low- and middle-income countries, including Ukraine.

The WHO cites the example of Colombia, which is second only to Paraguay in the cheapness of cigarettes in the Western Hemisphere. After the increase in cigarette taxes, the prevalence of smoking in the country decreased by 34%.

In Ukraine, the cost of cigarettes is still one of the lowest in Europe. Although the mechanism that will soon change this has already been launched.

And if the adoption of regulatory decisions to reduce the prevalence of smoking in Ukraine is delayed for years because it is the bargaining chip with tobacco lobbyists, for example, the profile draft law №4358 has been waiting for consideration in the second reading in the Verkhovna Rada for about a year, then the excise policy completely coincides with the government's desire to fill the budget quickly.

"Seven-year plan" to increase excise taxes

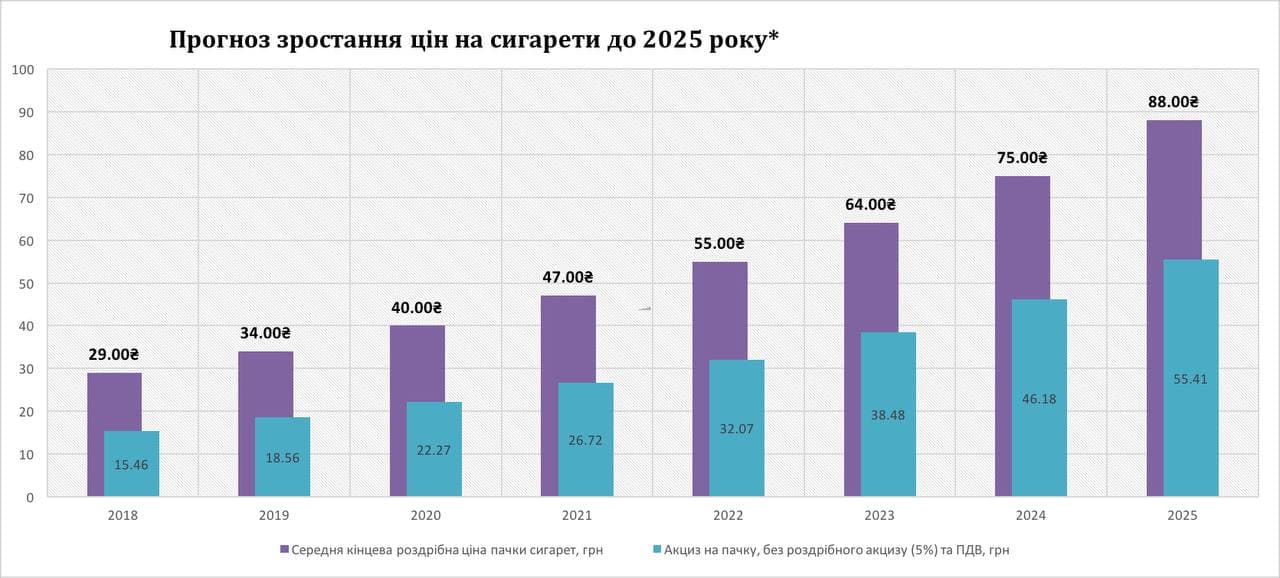

In 2017, Ukraine passed a law approving a plan to gradually increase the excise tax rate on cigarettes. It provided for a 30% increase in excise duty in 2018, a two-stage increase in 2019, and, starting in 2020 and over the next six years, a gradual increase in the rate by 20% annually.

The main purpose of such measures is to reduce the affordability of tobacco products and bring the cost of cigarettes closer in Ukraine to European countries, as a significant difference in price is the main cause of smuggling.

Thus, from January 1, 2021, the rate of specific excise duty is UAH 1089 per 1000 cigarettes. And taking into account the ad valorem rate (12% of the retail price), the minimum excise tax liability is UAH 1,213.61 per 1,000 cigarettes. That is, this year taxes and fees from a pack of 20 cigarettes are at least UAH 29.13.

By 2025, the specific rate of excise tax will increase to UAH 2,257.4 per 1,000 cigarettes. And the minimum excise tax liability will be UAH 3,019.85 per 1,000 units. That is, you will have to pay at least UAH 60.4 tax for each pack of cigarettes.

Experts from the Ukrainian Tobacco Control Center tried to predict how the retail price of cigarettes would change, given the increase in the excise tax rate. They note that after 2021 the cost of the pack will increase by 8-11 hryvnias annually. By 2025, the price of a pack of cigarettes may reach UAH 88.

However, given the rate of inflation, which remains at 10% in 2021, such a forecast of the cost of cigarettes may seem too optimistic and the real cost of a pack of cigarettes will be much higher.

This situation will allow hitting several targets at once: it will help reduce the prevalence of smoking, especially among adolescents and young people, reduce health care costs and significantly increase the budget.

According to the forecasts given in the analytical note of KSE, the discounted (considering the value of money over time – ed.) amount of tax revenues from 2021 to 2025 will be UAH 426 billion (including UAH 319 billion of excise tax revenues).

Cigarette consumption (including illegal products) will decline by an average of 5.6% annually (from approximately 45.3 billion cigarettes in 2020 to almost 34 billion cigarettes in 2025).

With the rising cost of traditional cigarettes, tobacco companies have begun to rely on e-cigarettes and Glo and IQOS tobacco heating devices, which are not subject to legal restrictions and tax regulations.

Therefore, another progressive solution in 2020 is to increase the tax on heated tobacco products (HTPs) to the level of excise rates on cigarettes.

In the first half of this year alone, the increase in excise duties on HTPs brought UAH 5.2 billion to the budget, while excise revenues for the whole of 2020 from HTPs amounted to only UAH 1.7 billion.

According to forecasts, from 2021 to 2025 these changes may bring UAH 131 billion. Another important effect is the rise in the price of tobacco products, which makes them less accessible to many people and helps reduce the prevalence of smoking.

The results of a study conducted on the platform LibertyReport.AI suggest that the price of cigarettes is one of the key factors to reducing the prevalence of smoking.

60% of smokers are ready to quit smoking if the price of a pack of cigarettes rises to UAH 250-300. Another 25% would look for cheaper options and only 11% would continue to smoke.

The main role in shaping the price of cigarettes is played by the state, which sets excise tax rates because the cost of such products is quite low.

Growth of illegal products and 13 billion unpaid taxes

The laws of economics work well for the tobacco industry as well; the higher the taxes, the more expensive the product, and the fewer people are willing to buy it. But there is another connection: the higher the taxes, the more market players are interested in evading them.

With a significant rise in excise duty, the market is becoming increasingly attractive to producers of illegal cigarettes and contraband. And if smuggling from most of the neighboring countries to Ukraine is not yet economically viable, the tendency to increase illegal production for the domestic market can be seen quite clearly.

According to a study by Kantar Ukraine, in 2021 the share of illegal trade in tobacco products in Ukraine is 14.4%.

Analysts note that this share of illegal tobacco products is the highest in the last 10 years since the company conducted the study.

If the average annual rate of counterfeit products, contraband, and cigarettes labeled for Duty-Free or for export, which are illegally sold in Ukraine, did not exceed 2% in 2015-2016, in 2018, the share was 4.4%, and in the next two years, it approached 7%. In 2021, this figure doubled.

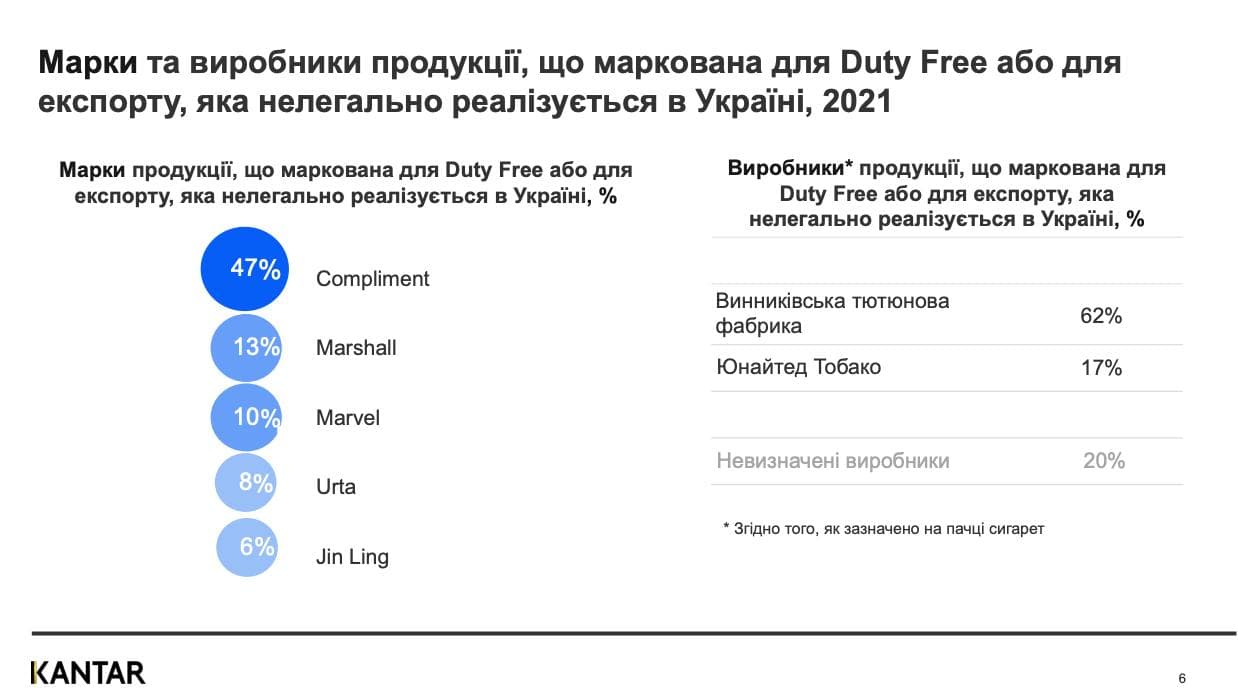

The authors of the study from Kantar Ukraine note that almost 80% of products for Duty-Free, illegally sold on the Ukrainian market with tax evasion, are manufactured by two companies: Vynnyky Tobacco Factory (62%) and United Tobacco (17%).

Compared to 2020, the share of tobacco products labeled for Duty-Free or export has increased significantly. If only 2.8% of such cigarettes were sold in 2020, then in 2021, it's 7.6%. Moreover, there is a tendency to increase the share of such cigarettes. If in February it was 6.9%, then in May, it's 8.2%.

Cigarettes for sale in duty-free zones and with appropriate labeling are manufactured by legal manufacturers. Documents for driving up the volume of the order are received in collusion with Duty-Free stores.

"The cashier secretly makes a transaction on such products on your boarding pass. According to the documents, the goods left Duty Free, but they didn't fly abroad with the passenger but entered the Ukrainian market without paying taxes. Under this scheme, legal manufacturers illegally manufacture goods on their facilities," the former head of the State Fiscal Service (SFS) Vadym Melnyk explains how the scheme works.

Subsequently, such cigarettes are usually sold through kiosks and shops in various regions of Ukraine. Most often in Odesa, Kharkiv, and Donetsk. Their cost is significantly lower than cigarettes on which taxes have been paid, and sales in this way have tripled compared to last year.

The state policy of increasing excise duties on tobacco products is effective despite the growing level of illegal trade in tobacco products. State budget revenues from excises on tobacco products in 2021 continue to grow.

How to fight the illegal market?

An important step in the fight against the smuggling of tobacco products at the state level is the Protocol on the Elimination of Illicit Trade in Tobacco Products. The document entered into force in 2018 and was ratified by 57 states.

Ukraine hasn't ratified the Protocol, although the Government has approved a draft law that will allow it to ratify in 2017. Ratification is required within Ukraine's international obligations: Article 352 of the Association Agreement between Ukraine and the EU and Article 15 of the WHO Framework Convention on Tobacco Control, which Ukraine ratified in 2006.

The president has to register the draft law in the Verkhovna Rada. During Petro Poroshenko's presidency, the Foreign Ministry sent a package of documents to the Presidential Administration twice, but they returned it twice with remarks.

In 2019, the Ministry of Health prepared the necessary package of documents, and the Ministry of Foreign Affairs sent this package to the Office of President Zelenskyy. However, there has been no progress on this issue in two years.

The most important norm provided for by the ratification of the Protocol is the introduction of an intergovernmental system for tracking tobacco products. Each pack of cigarettes is marked with unique identification marks, which will allow determining at what point the cigarettes went out of legal circulation and entered the illegal market.

The implementation of such a system is required by Directive 2014/40/EU. Labeling would make it possible to prosecute legal producers who produce products for the shadow market in large quantities in the "third shift."

Smuggling criminalization would protect the Ukrainian market from the influx of illegal products from Belarus, Russia, and the occupied territories of the Donetsk and Luhansk regions. After several stages of raising excise taxes in Ukraine, the smuggling of legal cigarettes to the EU will cease to be economically viable and will disappear as a phenomenon.

For illegal producers, the prospect of imprisonment may be a better stimulant than financial punishment.

Now the relevant draft law has been adopted in the first reading and is awaiting final consideration in the Verkhovna Rada.

Criminalization is also supported by the State Border Guard Service of Ukraine, emphasizing that Ukraine remains almost the only country in Europe where the responsibility for smuggling is not criminalized.

They die early: how Ukrainian laws (do not) help prevent smoking

Banning smoking in Ukraine? What does and doesn't a new anti-tobacco draft law have?

Find out more in our special project, Tobacco in Ukraine: who decides the fate of Ukrainians' health and market