Remember the invisible hand of the market? This pricing system strikes a balance between supply and demand through a choice of buyer and seller. Adam Smith formulated this principle of market self-regulation. According to him, personal gain, i.e., the desire to pursue their interests, forces manufacturers to create what customers need, even at the lowest price.

Price is a monetary expression of the value paid or received per unit of goods or services. Friedrich von Hayek called the market system a miracle because a single indicator—the price of goods—carries a lot of information and helps sellers and buyers to make decisions that will help them get what they want.

How does the market shape it?

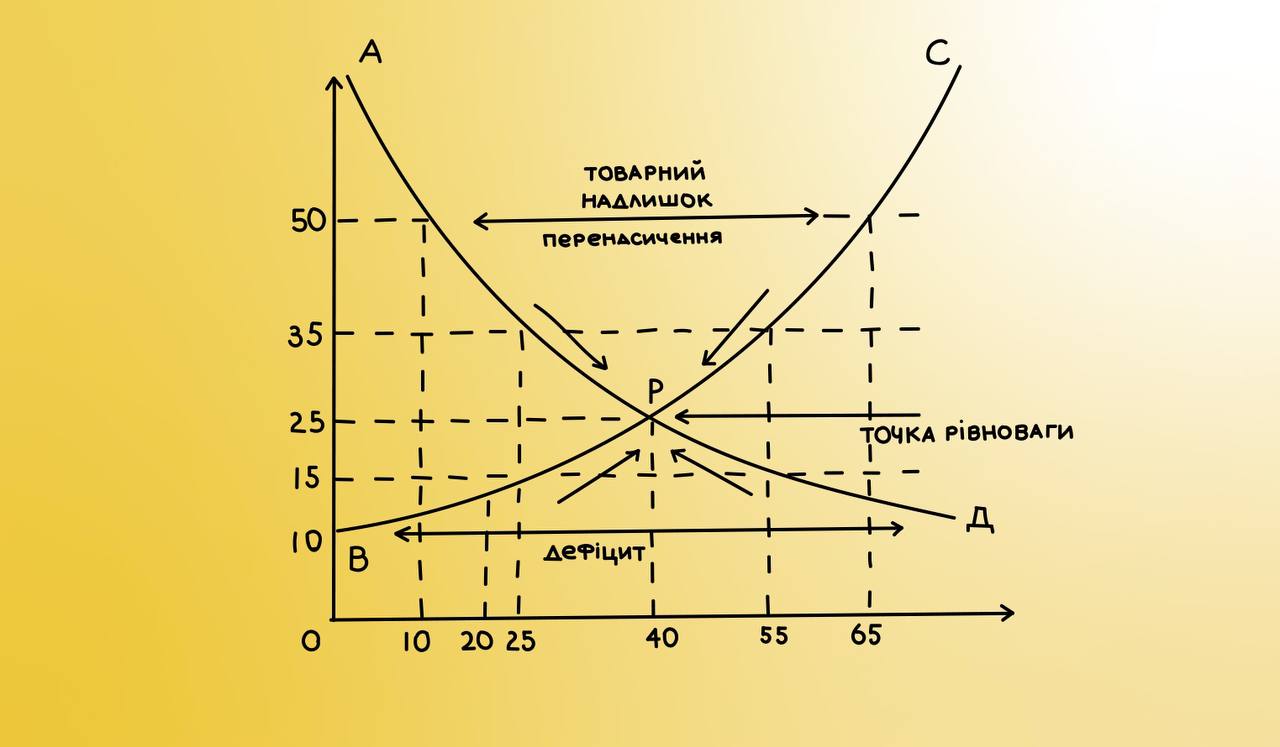

We, as consumers, want to get the most out of our limited resources. We purchase what we value more than we pay. The price helps us to compare the desired product with an alternative product, that is, one that we can buy instead. At the same time, because different buyers have different needs and opportunities, the higher the price, the fewer those buyers who consider it profitable to purchase this product or service and have the money to do so. This inverse relationship is known as the law of demand.

In turn, sellers—producers and importers—supply the market with what gives them the most profit, i.e., the difference between the selling price (which reflects consumer utility) and cost. The latter is also different for different suppliers, so the price increase attracts additional suppliers. This direct dependence is known as the law of supply.

How does it work?

If suppliers offer more items than consumers want to buy, there will be a surplus of supply, which will force sellers to reduce the price to get rid of these stocks. Those with the highest cost will suffer losses and likely leave this market. The price will fall until it reaches a level where the quantity of goods consumers are willing to buy equals the amount sellers are eager to supply. If the price is below equilibrium, consumers will want to buy more than sellers are willing to offer. It will lead to excess demand, in response to which market forces will push the price up. Therefore, there's constant coordination of buyers' and sellers' behavior, resulting in a price that satisfies both sellers and buyers and the balance between supply and demand.

Where do deficits come from?

Why then is there a shortage or surplus of goods and services? In a free market, they are rare because all its participants receive price signals. Sellers cannot sell more or at a higher price than buyers are willing to pay. Otherwise, there will be a surplus of supply, and some sellers will not be able to recoup their costs. Market prices strike a balance between demand and supply, but they also direct suppliers to offer goods that buyers value more than the cost of their production or import. This spontaneous order doesn't require centralized planning but is established because prices coordinate people's interests. However, sometimes public policy prevails over price signals, lowering costs through taxes, subsidies, and marginal prices.

What does the fuel have to do with it?

Take, for example, the fuel situation in Ukraine. All drivers must have already experienced the deficit: those who try to work, get to work, evacuate relatives and ordinary people, deliver humanitarian aid, etc. Why is there a shortage? There are several reasons, including the shutdown of the Kremenchuk refinery, bombed oil depots, and unestablished and complicated logistics from Western Europe with a need to increase imports; state price regulation doesn't help.

Ukraine's Ministry of Economy introduced state regulation of fuel prices, i.e., limited the maximum retail prices for fuel in May 2021. This restriction applies to the trade margin that gas station networks can add to the average cost of petrol and diesel calculated by the ministry. From the end of February 2022, this surcharge was up to UAH 5/liter of gasoline and UAH 4.55/liter of diesel fuel. Under these conditions, the market's invisible hand doesn't work because the price is fixed and cannot rise to the level required by the deficit in the market, as in our case. If there were no marginal price for fuel, it would increase significantly, which would reduce demand for it. With the establishment of logistics across our western border, the cost would decline.

Meanwhile, we have low prices on paper, empty gas stations, and long queues.

About the project

The fact that only economists need economic knowledge is one of the greatest myths of our time. We all live in a world of limited resources, so we constantly have to make choices. Working and volunteering in the rear or volunteering at the front, doing homework or playing in the League of Legends, going to study programming or realizing the dream of your band, staying in a secure job or starting your startup, investing in Bitcoin or sports collectible cards, shoot TikTok video or improve your English? In such situations, economic thinking will help you make an informed choice. So let's think economically together!*

*The project is implemented in cooperation with the international educational initiative Economic Fundamentals Initiative with the support of the Atlas Network. The articles are based on the Common Sense Economics Handbook (https://www.econfun.org/uk).