Save or spend: what to do with money in wartime?

What currency to choose to maintain savings? Should you withdraw deposit funds from banks? Is it profitable to buy military government securities?

What is the problem?

Economic decline

A comprehensive assessment shows Ukraine's economy has fallen by 35% due to russia's full-scale invasion. Economists give disappointing forecasts regarding its recovery, use complex terms and give vague predictions. But what should Ukrainians do with their savings: spend because of possible devaluation or invest in bonds, waiting for the return of at least part of the investment? Rubryka analyzed this with expert Liubomyr Ostapiv, founder of the Family Budget social project and partner of iPlan.ua. Together, we explain everything in simple words.

What is the solution?

Should you spend your savings?

Any family should have a reserve fund for 3–6 months, Liubomyr Ostapiv emphasizes. If the family's income decreases, they can spend this family fund on everyday life. The expert gives an example:

"If we are talking about a family with a reserve fund, and they are contemplating a purchase, they need to consider why they need it. For example, buying a car that they can buy in Europe and import duty-free will be profitable because the car will cost cheaper than before the full-scale war. Given the problems with fuel and the rise in gasoline prices, one has to ask: can we do without a car now, and how much does our family need it?"

The family must consider each case separately, but the principle must be the same: maintain reserve funds that will last for at least a few months. If this rule was not carved into your family budget in peacetime, now is the time to consider a reserve fund.

Rent for a long term or buy an apartment?

The real estate market is virtually at a standstill, and most people are waiting for the hostilities to end. Regarding residential real estate in Kyiv, we should consider it by class: luxury, comfort, business, and economy. As Liubomyr Ostapiv predicts, there will be a demand for economy-class housing in the capital and its surroundings, created by evacuees from Mariupol, Donetsk, and Luhansk regions, who will not be able to return to their homes soon. On the other hand, before the full-scale invasion began, we had a record high rate of construction. It caused the supply to be greater than the demand. According to experts' forecasts, the prices of comfort, business, and economy-class real estate in Kyiv should decrease. What will be the decrease? Ten percent or fifty? We will know only after the end of hostilities when a full-fledged market will relaunch.

It would be imprudent to make precise predictions here, but according to an optimistic scenario, where the war will end by the end of this year, the expert says it would be more logical to rent an apartment. In addition, you should consider that rental prices in Kyiv have decreased significantly with the outflow of people to the country's western regions, and no one can assure that russia will not attack the central part of Ukraine again.

150-dollar salary, like in the 1990s?

One of the well-known Ukrainian investment bankers has recently stated that the average salary of Ukrainians is 150 dollars again, as in the 90s. Fortunately, Lyubomyr Ostapiv refutes this opinion, although he emphasizes that, unfortunately, we will not return to the pre-war record level of wages soon. That's still given the optimistic scenario: "Everyone understands we won't have the post-independence record of $590 for average wages. We'll lose a third to a half of GDP, which is the people's jobs, salaries, and incomes. It happens in a scenario where the war ends by the end of this year, and we have the strong Western support we have now. After the victory, we'll need a major reconstruction of large infrastructure facilities, schools, kindergartens, housing, etc. If we can start it already this year, wages will be exactly over $150."

We can even hope for this forecast if we discuss an optimistic reconstruction scenario, where Ukraine is already a candidate for EU membership (already done!); state and private Western investments are coming to us. We are building modern factories, involving EU support programs, particularly loans and grants, and the Ukrainian diaspora is involved in the country's reconstruction.

Is it time to withdraw the deposit from the bank?

In 2014, people counted that the money in deposit accounts could be withdrawn at any time, but within weeks the banking system gave way, and depositors were left without money. One of the reasons for the drop is that the National Bank artificially maintained the hryvnia exchange rate for a very long time. Lyubomyr Ostapiv notes that after 2014, the banking system was reformed, new standards and requirements appeared, the number of banks decreased, and their activities are now transparent:

"President Zelensky, when speaking and addressing NATO, said: 'Never again say that the Ukrainian army doesn't meet NATO standards—in certain moments, it already exceeds them.' The same can be said about the banking system. After it has survived and worked stably in wartime, it's time for us to stop these discussions about trust or distrust of banks. The National Bank is an effective regulator; the banks are prepared and has worked normally and survived the war, which is a terrible force majeure. In some countries, the banking system closes on the second day of the war, and our banking system has been working successfully for us for months," the expert comments.

According to him, the Ukrainian banking system is already integrated into the European one and meets European standards, so banks should have more trust.

What currency to choose for savings?

If we are talking about the reserve fund, which we mentioned at the beginning, Liubomyr Ostapiv explains that it is money for consumption, so you should keep it in hryvnias. At the same time, it's necessary to maintain a balance, and the expert suggests a model where you own one-third of the reserves in dollars, one-third in euros, and one-third in hryvnias. In long-term financial accumulation, it is better to keep 90–100% of such savings in hard currency, dollars or euros, because such savings are more extensive and are saved for purchasing real estate or as a pension fund.

"In our half-destroyed economy, the hryvnia cannot be fixed. There will still be devaluation, but the National Bank will do everything to make it smooth and the shock moderate," Liubomyr explains.

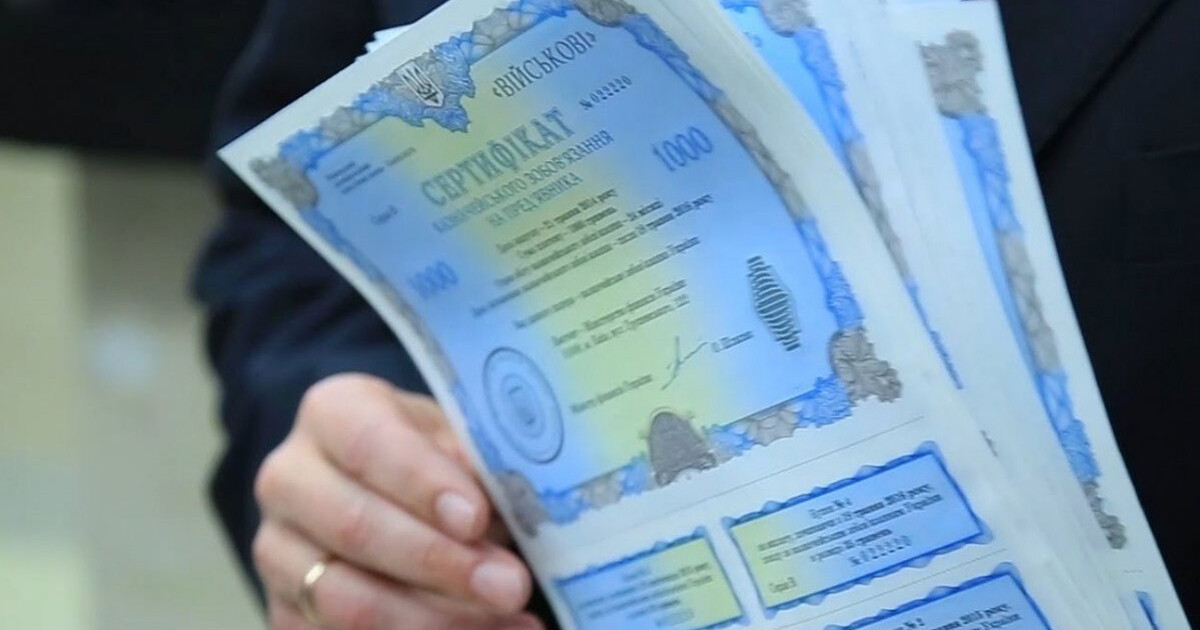

Should you buy military government securities?

Demand for government bonds is now growing—the fund is growing by thousands every day, and tens of thousands of people have already bought military securities:

"Let's be honest; it is an emotional investment in our victory," the expert comments. "When we buy securities, we earn 11% per annum in hryvnia. You cannot call such an investment reasonable in a warring country, where inflation will be 20% or even more. But many people, myself included, buy these securities because it's a way to support the government. Everyone who buys securities now understands: either we're investing in our military, or we will be feeding someone else's army. Buying government securities is one of the ways to invest in the state and support our armed forces," Mr. Ostapiv replies.

From the point of view of multiplying your assets, buying military government securities is not the best option. Still, if the amount you spend and return from the securities guaranteed is "under the mattress," you will lose twice as much to inflation than if you invested in our victory.