Rubryka analyzed how the state excise policy works, why reasonable solutions didn't work as they should and what should be done to reduce the level of smoking in Ukraine.

Addiction Industry

Ukrainian laws do not prohibit the use of tobacco. Every cigarette pack warns about harm to health. Then it is a matter of personal choice, so why should the state interfere?

Smoking is not a habit that one can easily abandon at any moment. This addiction appears in a person at the psychological and physical levels. Nicotine enters the bloodstream, and after 7-10 seconds, it reaches the brain, stimulating the nervous system to artificially produce dopamine and serotonin. This is how a feeling of satisfaction appears. The brain remembers this "shortcut" to pleasant sensations, and addiction is formed.

At the same time, nicotine that accumulates in the body weakens it and gradually annihilates the self-destruction mechanism of cells. Instead of dying after completing their functions, cells continue to divide uncontrollably. This is how cancer occurs.

So, smoking is a public health problem.

But smoking not only worsens the health of smokers and those around them but also makes countries poorer. Every year, the Ukrainian economy loses about 3.2% of its GDP due to the costs of treating diseases—the consequences of active and passive smoking, the loss of working capacity of Ukrainians, and the premature death of some of them.

In 2021, the damage due to smoking reached 179 billion hryvnias. For comparison, constructing one school with a thousand educational places costs about 100 million hryvnias.

At the same time, the industry that sells cigarettes, hookahs, electronic cigarettes, and heated tobacco products (IQOS, Glo, and other means for heating tobacco) positions smoking as a status habit, a way to relax or add charisma. In most cases, children become smokers, and later people develop cancer and heart and lung diseases, which is the cause of premature death for 50% of tobacco users.

So, instead of building thousands of new schools, the state pays for the "personal habit" of smokers—130,000 die annually in Ukraine alone.

Increasing excise taxes as most effective policy

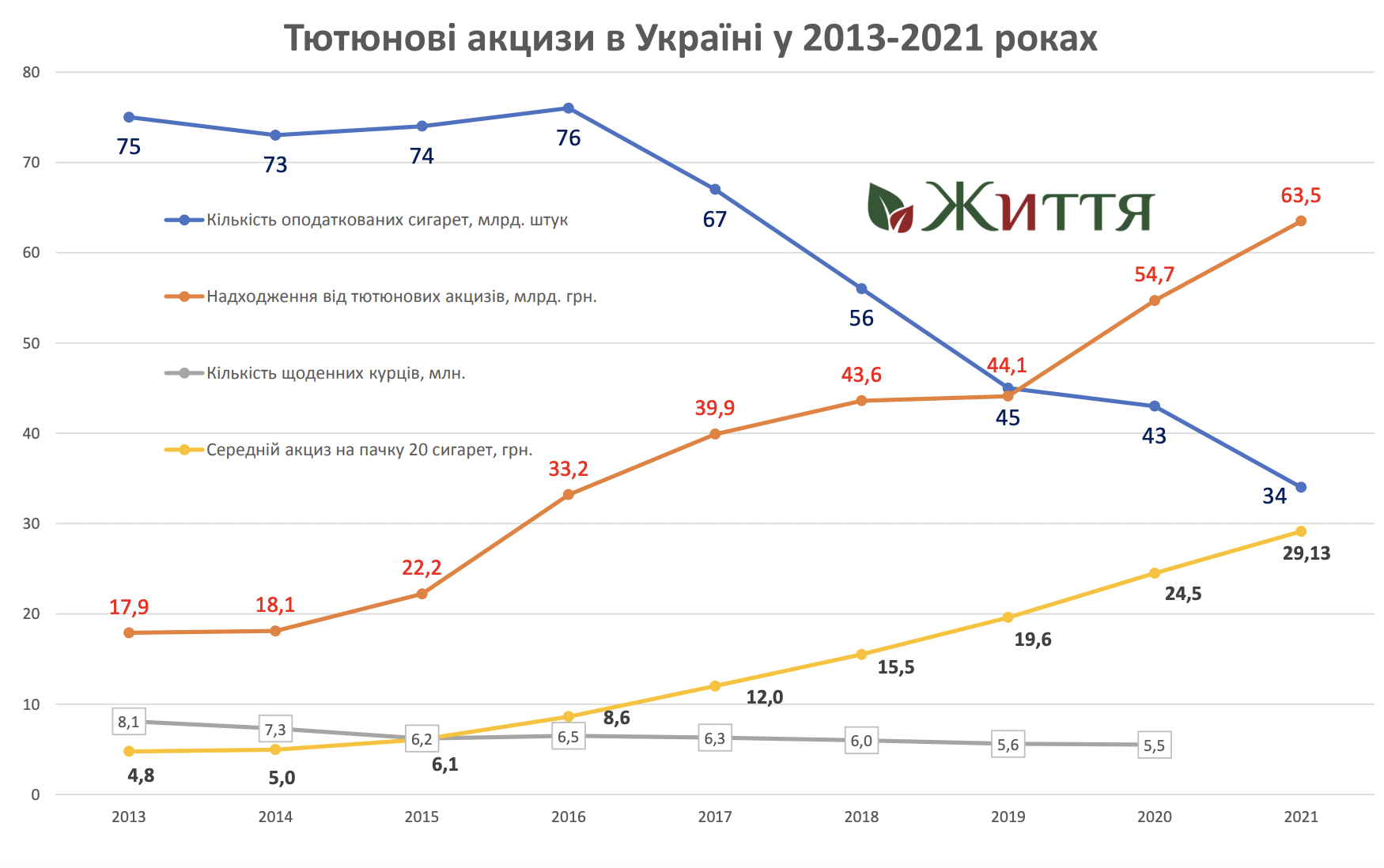

In 2017, Ukraine adopted a seven-year plan to increase excise taxes on tobacco products and adopted an amendment to the Tax Code, which provides for a gradual increase in the excise tax rate on cigarettes. Thus, in 2018 there was a 30% increase in excise duty. In 2019, there was a two-stage increase, and there will be a gradual increase in the rate by 20% each year starting in 2020 and over the next six years.

"The primary task of this excise tax increase plan is to bring excise taxes, and therefore the price of tobacco products in Ukraine, to the minimum cost of the same products in the EU. This is necessary amid the European integration processes in Ukraine, as well as to reduce the level of profitability of smuggling Ukrainian cigarettes to European markets, because there is a significant difference in the price of cigarettes in Ukraine, Poland, Germany, etc.," the lawyer of the Center for Democracy and Rule of Law Hleb Kolesov explains.

The expert says, in general, there are two ways to combat smoking at the state level. The first involves placing medical warnings on cigarette packs, banning advertising, sponsoring tobacco products, conducting health campaigns, etc.

The second is the increase in prices for tobacco products, which narrows the circle of people who will be financially comfortable supporting their addiction. The most effective option is to apply both solutions at the same time.

"If we talk about price measures, the most striking examples are Georgia, France, Denmark, Sweden, and other European countries, where a significant increase in excise taxes in recent years has reduced smoking among the population. In particular, the Ministry of Health of France reported in 2017 on the first successes of high cigarette prices. According to their research, the number of daily smokers was one million fewer than the previous year, in 2016. By the way, France has one of the highest excise taxes and, accordingly, the cost of cigarettes in the EU.

It is also worth mentioning the US experience, where every 10 percent increase in the price of cigarettes reduces cigarette consumption by about four percent among adults and about seven percent among young people," says Hleb Kolesov.[/blockquote_with_author]

If we talk about the smokers themselves, many of those who have been smoking for years admit that if the price of cigarettes continues to rise, the moment will come when they will have to say goodbye to addiction.

Viktor is 26 years old. The man started smoking at the age of 19. He tried to quit several times, but in a month or two, he reached for a cigarette again. Now he buys a block of cigarettes at once. There are ten packs in one. It costs Viktor 820 hryvnias, and such a supply is enough for about a week.

"I'm thinking about quitting smoking again. With the start of a full-scale war, my expenses have increased. My friends in the military need financial help. My brother lost his job… In addition, food prices are rising. While the price of cigarettes is such an island of stability for me, if in a week I spend more than a thousand on them, then I will smoke each one with the thought that my new laptop, unpurchased car, and unpurchased drone for the guys on the front lines are smoldering on the tip of the cigarette. I'm having more and more such thoughts now," Viktor shares.

But there are also smokers for whom the price is less critical. Vasyl has been smoking for 32 years out of his 49 years. The man is unequivocal in his views.

"I don't remember myself without a cigarette. It's my way to relax, think, and reset. I'm ready to spend less on sweets, coffee, or new clothes. But I don't want to quit smoking. It will be too difficult for me. I don't see the meaning of this," Vasyl explains.

Inflation, the police, and other miscalculations

Implementing the "7-year plan" to increase excise duties on tobacco products has proven its effectiveness. While the consumption of cigarettes decreased, the revenue to the State Budget from tobacco excises increased sharply from UAH 43.6 billion in 2018 to UAH 63.5 billion in 2021.

A big step forward was also the fact that in 2021-2022, in matters of advertising, sales to minors, and the ban on smoking in public places, deputies equated heated tobacco products (HTPs) with ordinary cigarettes and also equalized the products in terms of excise taxes.

People's deputy and head of the Committee on Finance, Tax and Customs Policy of the Verkhovna Rada of Ukraine, Danylo Hetmantsev, in his comments for Rubryka, emphasized that the decision turned out to be unequivocally correct.

"Equalizing excise duties on HTPs with excise duties on filter cigarettes last year brought more than 10 billion hryvnias to the state budget. And this is in the absence of a shadow market for HTPs, despite the 'horror stories' told to us by the industry. It was the right and timely decision that we managed to make despite the opposition of lobbyists.

According to the data of the State Tax Service of Ukraine, excise duties on heated tobacco products (HTP) increased six times—from 1.7 billion UAH in 2020 to 10.2 billion UAH in 2021. Such revenue estimates are close to the Kyiv School of Economics assessment, which predicted that excise duties for HTPs could reach 11.3 billion hryvnias in 2021.

Revenues of UAH 10.2 billion from excise taxes on heated tobacco products (HTPs) are more than two times higher than the amount of excise duty (UAH 4.8 billion), which tobacco companies and business associations affiliated with them 'guaranteed' to pay in 2021 in exchange for a reduction in the excise tax on this tobacco product. If the tobacco companies' proposals were accepted, the State Budget would lack at least UAH 3 billion in 2021 and dozens of billions of hryvnias in the following years. However, the Government, the Parliament, and the public defended the public interest, which provided billions in tax revenue from products that have no public benefit and directly harm consumers' health.

For Ukraine's success in harmonizing the excise tax on HTPs to the level of cigarettes, WHO Chair Tedros Ghebreyesus congratulated Volodymyr Zelensky in 2021.

Every year, excise taxes rise by 20%, which will be the case until 2025," says Danylo Hetmantsev.

The creators of the excise plan of Ukraine did not consider the rapid growth of inflation, which was noticeably affected first by the coronavirus pandemic and later by a full-scale war. Hleb Kolesov calls it a big problem.

"Unfortunately, the legislator did not consider several factors, particularly the possibility of a full-scale war. Of course, looking at the exchange rate, the cost of cigarettes, and excise taxes, we see a lag in the growth of the cost of cigarettes.

As far as I know, individual deputies have already stated the need to revise the excise tax rate considering the current situation. These are not only European integration obligations. First, it is about filling the country's budget in a state of war because the excise tax is one of the largest sources of income.

Is it an urgent problem? Yes. We're seeing price increases for everything from fuel to groceries. Cigarettes currently remain almost the only commodity that does not increase in price. This negatively affects both the level of smoking and the potential for the growth of smuggling of cheap Ukrainian cigarettes to European countries," the lawyer explains.

The narrative that increasing excise taxes will also increase the illegal circulation of tobacco products is one of the favorite myths that the tobacco industry disperses. But Danylo Hetmantsev calls such theories exaggerated.

"Excise duty makes up most of the final cost of a pack of cigarettes. Therefore, contraband cigarettes will always be 60-70% cheaper. This is independent of raising the excise tax on cigarettes by 20%. The rise itself is not critical to the growth of the shadow market.

I see an antidote to the shadow market of selling cigarettes exclusively in the normal work of law enforcement officers. Indeed, today such work is unsatisfactory. I am frankly ashamed of the helplessness of the Bureau of Economic Security in this area. The new body we created did not work and needs to be restarted," says the official.

Lawyer Hleb Kolesov confirms his words. The expert says that you can often see materials in the media where experts discuss the need to curb the growth of excise taxes, as if due to an increase in the volume of smuggling.

"Actually, these are two different problems. Because state control over smuggling and counterfeiting, prevention, etc., does not depend on excise policy. And the rapid filling of the market with illegal products has happened before since contraband cigarettes still have a big difference in value compared to excise-duty legal cigarettes," says Hleb Kolesov.

The lawyer also says that draft laws on changes in excise rates for specific tobacco products from pieces to kilograms are often registered in parliament. Such an "increase in excise duty" will only reduce it. But taking into account the level of inflation in the excise policy will be a necessary solution.