New Maidan in Kyiv? What happens to the "euro plates"

According to the formula proposed in the draft laws, one can get customs clearance for the car 4 times cheaper, and also avoid a fine of 170 thousand hryvnias. Whether the drafts will be passed in the second reading, we'll find out in the coming days. We explain when the draft law salving customs clearance will be adopted and who's against the accessible cars.

For several years now, from time to time, Hrushevskoho Street in Kyiv has been turning into a site of strikes by the owners of Euro plates; drivers who haven't got customs clearance for cars brought from abroad yet are protesting against inflated fines and high excise taxes that they have to pay. Cars parked along the road are full of flags and stickers with slogans, and the city center is once again turning into Euromaidan.

There's some progress: for example, earlier the committee on finance, tax, and customs policy adopted draft law No. 3704, finalized together with representatives of AvtoEvroSila. It abolishes the excise tax on passenger cars, bodies for them, trailers and semi-trailers, motorcycles, passenger and cargo vans, and now, perhaps, two more laws will soon be adopted, according to which euro-distributors will receive a six-month deferral of fines and will be able to get customs clearance for their cars without significant damage to their finances.

What changes are possible?

Drafts 4643-d and 4644-d proposed changes to the Tax and Customs Codes of Ukraine regarding tax collection and simplification of customs clearance of vehicles imported into the customs territory of Ukraine. The draft laws propose a new formula for calculating the excise tax, which will be valid for 6 months (180 days) after the law enters into force (2 months after its adoption), and will also release the owners of Euro plates from administrative liability, a fine of 170 thousand hryvnias, under the following conditions:

- the owner of the car will voluntarily pay a fee of 8500 thousand hryvnias;

- one owner will be able to register only one car;

- the car was brought into the territory of Ukraine no later than December 31, 2020.

It is because of the high public response that the lawmakers explain the need for such temporary changes: "A draft law was developed that is aimed at solving this issue taking into account the positions of all segments of the population and the expert environment," an explanatory note to both drafts adopted as a basis by the Verkhovna Rada on January 18 stated.

Will the drafts be adopted? "AvtoEvroSila" gives an opinion

Ivan Kazachuk, a lawyer for the AvtoEvroSila euro-platers movement, believes that drafts 4643-d and 4644-d if they're adopted, will become only a temporary panacea: "It's a half-measure. It's for six months, and then again the situation with customs clearance will return to the same point where it's now: again, crazy rates, an inaccessible car that people cannot afford."

The process with adopting drafts 4643-d and 4644-d, according to the representative of AvtoEvroSila, is artificially delayed: "For the record, the main instigator and the 'gritter' is Hetmantsev, the head of the committee who's not interested in adopting these draft laws and solving this issue," the lawyer told Rubryka. The representative of AvtoEvroSila told about an alternative draft law, which is also in the committee of the Verkhovna Rada — № 3704. It postulates a complete abolition of excise tax, removing cars from the excisable group, removing artificial obstacles to auto-lobbyists.

"It's a popular, comprehensive, large draft law that satisfies the interests of all participants, except for Hetmantsev and auto-oligarchs," Ivan Kazachuk explained.

According to Kazachuk, this draft, unfortunately, didn't receive proper support in the parliamentary committee, it wasn't even put to a vote, so the supporters of AvtoEvroSila are trying to adapt the drafts 4643-d to the draft №3704, introducing the second provision into the first, and adding amendments. Some of them have already been adopted by the committee at a meeting on April 8, and another part has been rejected. A total of about 200 such amendments are expected. The lawyer hopes that they can be adopted on the second reading, "through the hall," during the voting of the deputies.

According to preliminary data, drafts should be put up for voting on April 15, Thursday. But our source told us that recent information had surfaced: it's possible that the second reading will be postponed until May:

"May doesn't satisfy us, because, after May, the summer break begins. This may be another 'soft-soaping,' another dragging out of the process: first, we'll be postponed to May, then they'll say that the second reading is to happen after the break, then in the fall, after quarantine, new year, and again everything is the same. Therefore, if this week the law isn't put to a vote, I think protests will resume. Again, there'll be a large-scale demonstration, all of Ukraine will come to Kyiv, we'll block the government block. If they don't hear us. Everything will be clear the day after tomorrow [April 15 – ed.]," Kazachuk summed up.

How will the tax rate be calculated?

If drafts 4643-d and 4644-d are still adopted, the new formula for calculating the excise tax looks like this: Rate = Base rate + Ve + Fe.

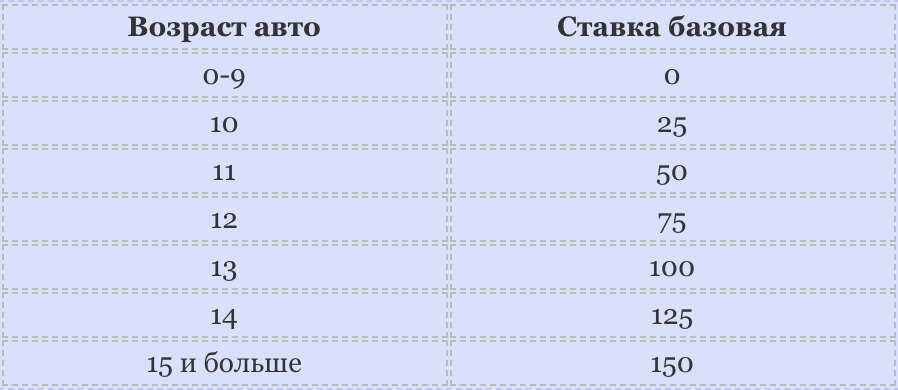

The base rate is the tax rate in euros per vehicle unit, which is determined based on the number of years from the production year to the year the tax rate was determined.

Ve is the tax rate in euros for 1 car, which is determined by multiplying the volume of the engine cylinders in cubic centimeters per coefficient:

- 0.25 euros per 1 cubic cm for engines up to 2000 cc (inclusive);

- 0.2 euros per 1 cubic cm for engines from 2001 cc up to 3000 cubic centimeters (inclusive);

- 0.25 euros per 1 cubic cm for engines from 3001 cc up to 4000 cubic centimeters (inclusive);

- 0.35 euros for 1 cubic cm for engines from 4001 cc up to 5000 cubic centimeters (inclusive);

- 0.5 euro for 1 cubic cm for internal combustion engines over 5000 cubic centimeters.

Fe is a tax rate in euros for 1 vehicle:

- for vehicles equipped with a combustion engine with spark-plug ignition and crank gear, 0.0 euro;

- for vehicles equipped with a combustion engine with compression ignition (diesel or semi-diesel), 100.0 euros;

- for vehicles equipped with a combustion engine with spark-plug ignition and a crank gear or a combustion engine with compression ignition (diesel or semi-diesel) and an electric engine (one or more), 0.0 euro.

What are the conditions now, while the draft laws aren't adopted?

So far, the documents have successfully passed only the first reading; they'll enter into force only after the deputies vote for changes during the second reading, the laws are signed by the President and officially published. The regulations will take effect the next day after that.

The Code on Administrative Offenses of the Police also provides for the right of the police to fine drivers for driving a car with a foreign registration that hasn't left Ukraine promptly or isn't registered under the law. The fine is UAH 8500 and is imposed by the police at the scene of the offense (part 8 of article 121 of the Code on Administrative Offenses). The car isn't seized the first time.

If the car is imported into the territory of Ukraine and isn't cleared by customs for a month or more, the driver, under Part 6 of Art. 481 of the Customs Code of Ukraine, faces a fine of 170 thousand hryvnias and confiscation of the car in favor of the state.

This liability can be avoided, but only if the driver provides documented evidence that the car wasn't cleared by customs due to force majeure circumstances or unlawful actions of third parties: Art. 460 of the Customs Code says it. In this case, the driver will have to litigate the ruling in court and defend his/her right to the car. If the court decides in favor of the driver, the vehicle will still have to be cleared by customs.