Solution for reconstruction: Ukrainian housing market recovered in all segments in 2023

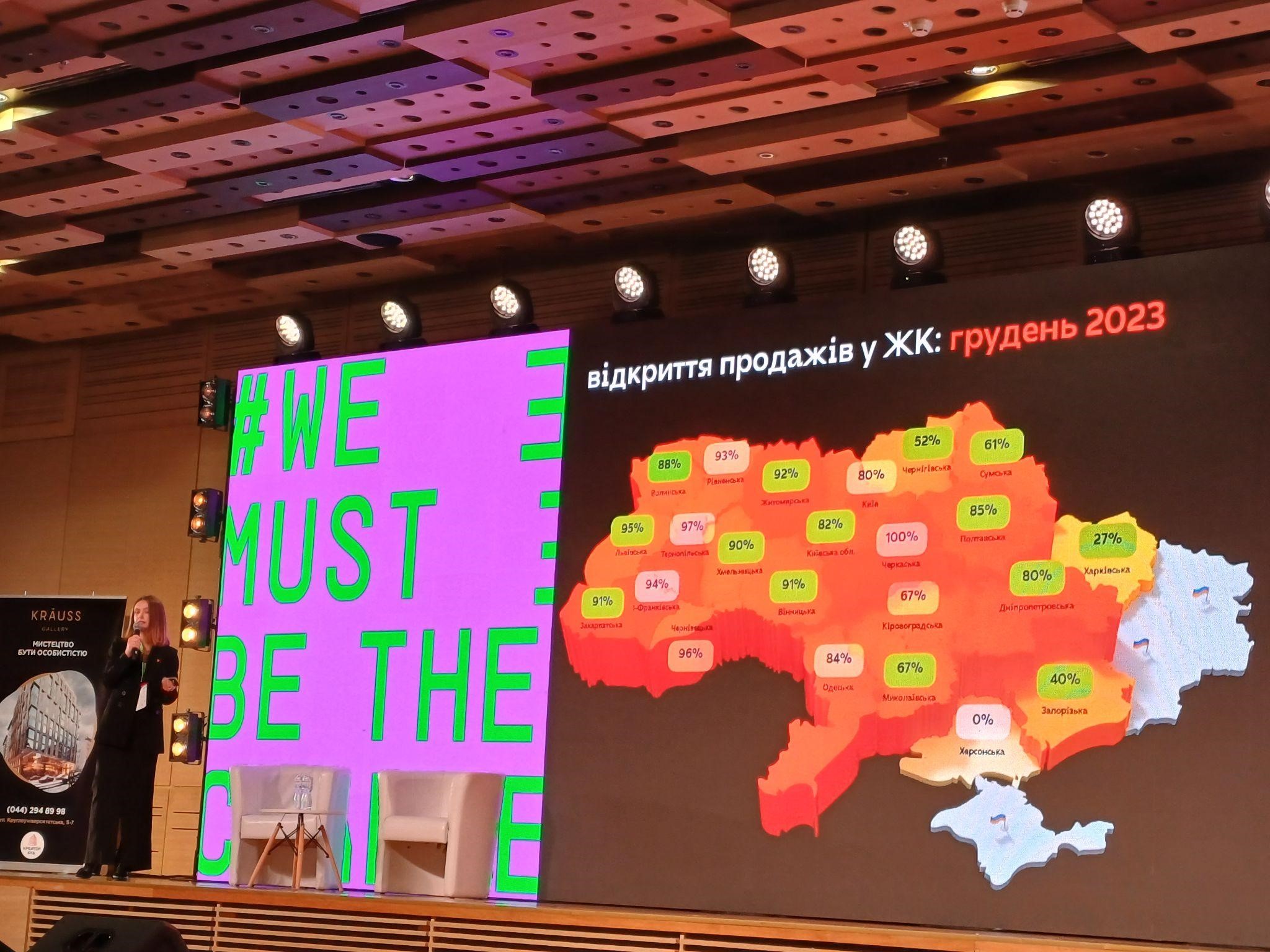

Compared to 2021, the Ukrainian real estate market has rebounded, with the most significant recovery happening in western regions of Ukraine.

Interestingly, Lviv now leads in the price per square meter for newly built housing, surpassing the capital Kyiv, according to Olha Okhrimenko, the sales director at LUN, during the Ukrainian Construction Congress, Rubryka reports.

What's the problem?

Since the full-scale Russian aggression against Ukraine, the real estate market froze, gradually starting to recover towards the end of 2022. This had a negative impact on the country's economy and the market's ability to meet societal needs.

What's the solution?

In 2023, the market adapted to new conditions, according to LUN's search engine analytics. Currently, the market is growing more actively in western regions of Ukraine. Based on monitoring data, Olha Okhrymenko, the sales director at LUN, expects the market to stabilize in 2024.

How does it work?

"Currently, 83% of sales departments in residential complexes are open across Ukraine," said Olha Okhrimenko, citing data on the new construction market. Compared to 2022, there has been a 5% increase in open sales departments for apartments in new buildings nationwide.

A similar trend is observed in construction recovery, with the highest rate in western Ukraine. The closer a region is to the conflict zone, the less construction recovery is observed.

Compared to 2022, construction has increased by another four percent.

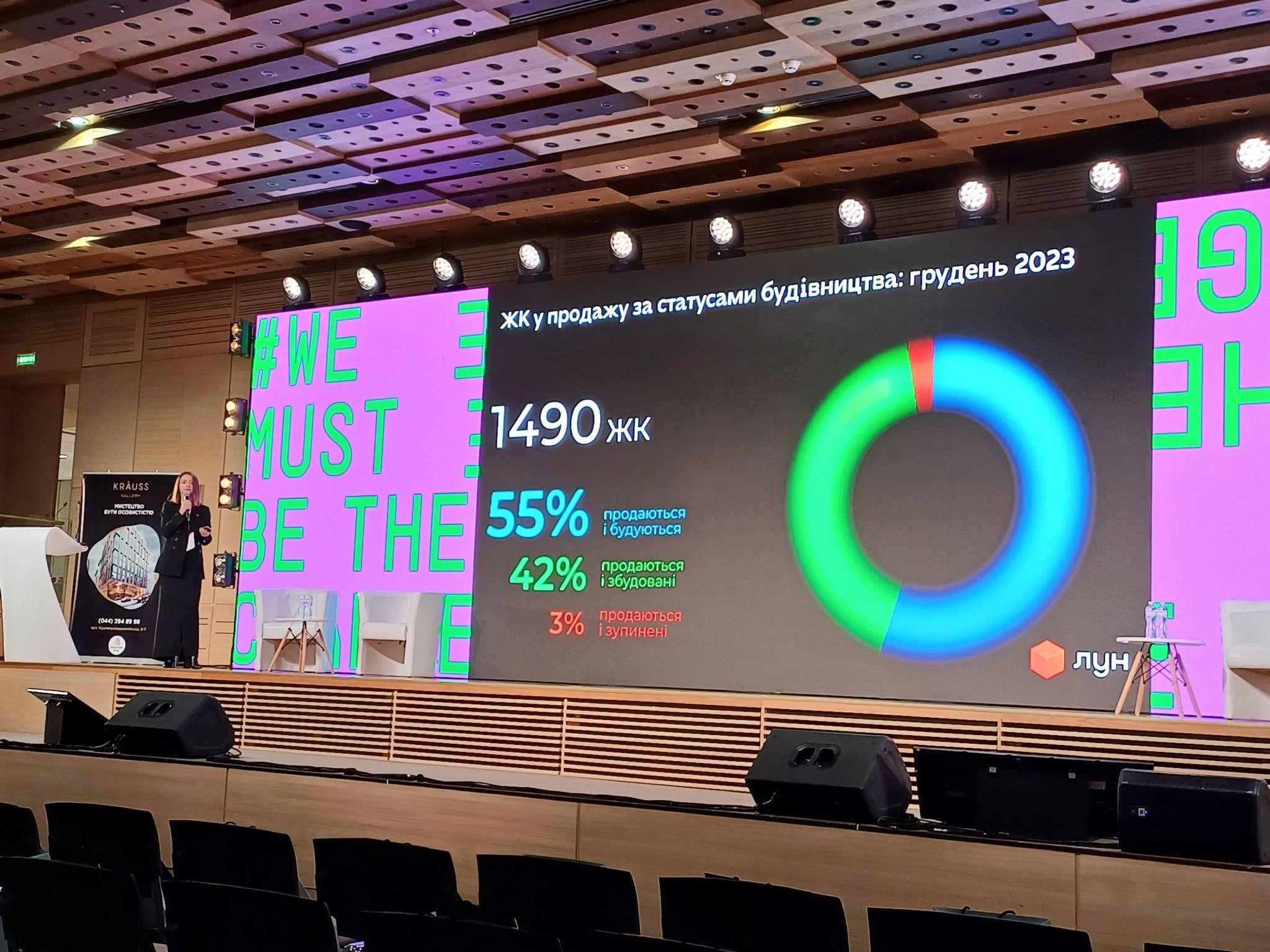

Across Ukraine (excluding the occupied part), LUN data shows that almost 1,500 residential complexes have open sales. More than half of these projects are both being sold and built simultaneously, 42% are built and for sale, and only 3% are for sale but currently halted.

Overall, consumer interest in purchasing apartments is increasing, as noted by Olha Okhrimenko.

Currently, there are 916 residential complexes under construction in Ukraine, with nearly 90% already being sold and 4% under construction and already sold. After the full-scale invasion, 275 new projects were launched, with the Lviv region having the highest number, nearly twice as many as in the Kyiv region, followed by Ternopil, Ivano-Frankivsk, and Zakarpattia regions.

Kyiv region leads in the top six regions by the number of projects for sale. There are 412 residential complexes selling homes, constituting 28% of all currently selling projects in the market. The Kyiv region has 50 more projects for sale than Kyiv itself, as highlighted by Olha Okhrimenko. Following at a considerable distance are Lviv, Odesa, Ivano-Frankivsk, Khmelnytskyi, and Ternopil regions. Together, these six regions account for 70% of all projects for sale.

Regarding completed sales, 65% of projects concluded after the start of the full-scale invasion are located in Lviv, Kyiv, Ivano-Frankivsk, Odesa, and Ternopil regions. There are almost 300 completed projects in total.

How prices are changing

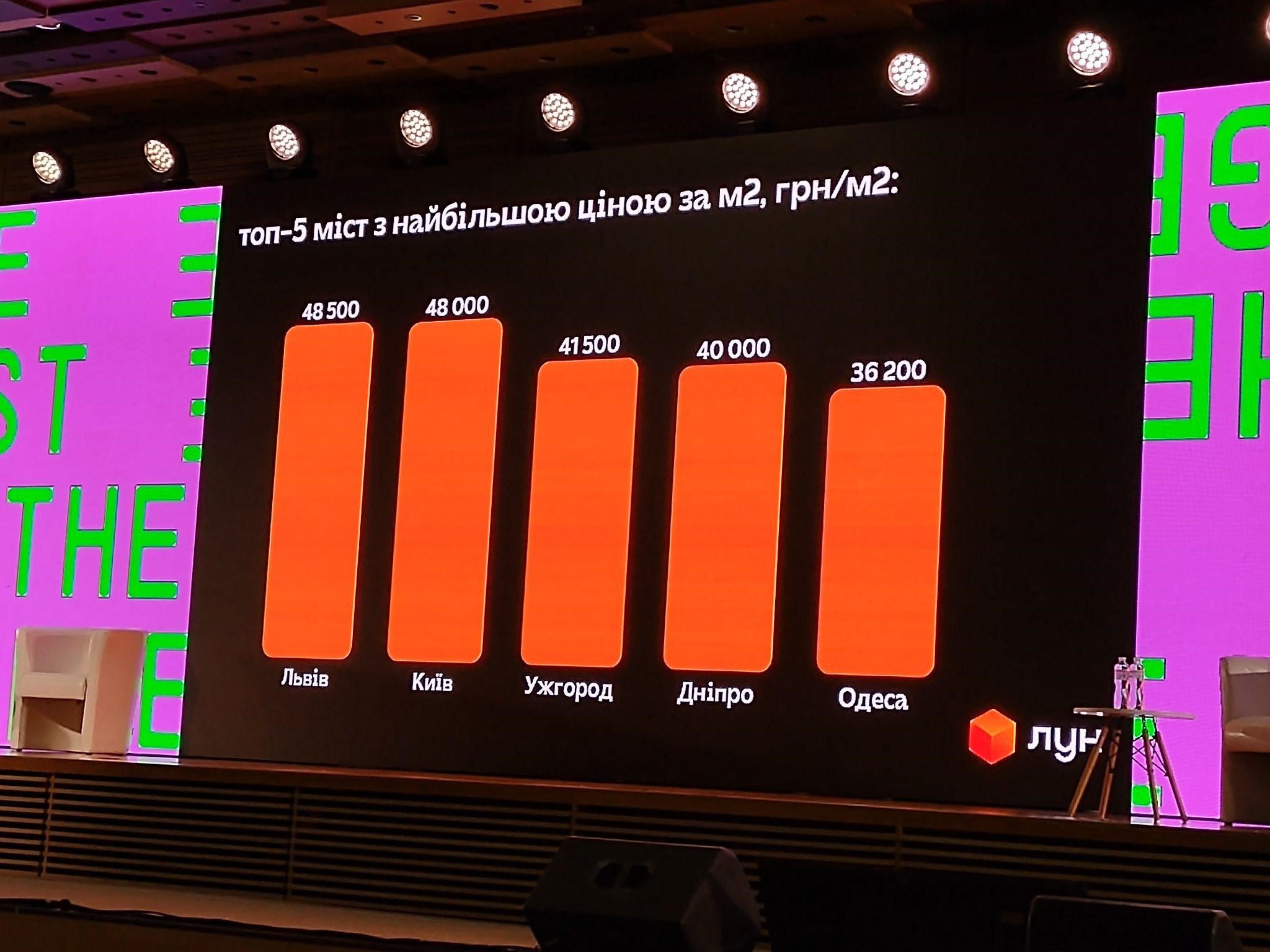

"Kyiv used to be at the top, but now Lviv is in the lead," said Olha Okhrimenko regarding the prices per square meter in new construction in regional centers.

Uzhhorod is in third place, Dnipro is fourth with a slight margin, and Odesa is fifth, with a more significant gap.

Regarding the secondary market, prices for such apartments are higher the farther they are from the conflict zone.

"Some people who lived in Kyiv have not returned yet, so the prices there are not rising. It's delayed demand. The most significant price increase for a one-room apartment in half a year was in Lviv," said the sales director at LUN.

Concerning the rental market, Olha Okhrimenko explained: "The demand for renting apartments in Ukraine once again emphasizes significant migration within Ukraine. Since August 2023, there has been a significant increase in demand for rental, the highest growth in the entire observation history."

Currently, Lviv is the most expensive region for renting, with a price of ₴16,000 for a one-room apartment, followed by Uzhhorod at ₴15,100 and Kyiv at ₴13,000. However, over the past six months, the capital's price has increased the most.

There is no publicly available data on the number of sold apartments, Olha Okhrimenko added. However, since 2018, LUN has conducted a closed certification study for developers containing questions about sales. Olha Okhrimenko shared an estimate of sales recovery based on this research:

"If we take sales in 2021 as 100%, then in new construction across Ukraine in 2022, they recovered to 10%. If we consider 2023, it's already 20%. Thus, sales across Ukraine doubled in a year, with the most significant growth in Kyiv and the surrounding region."

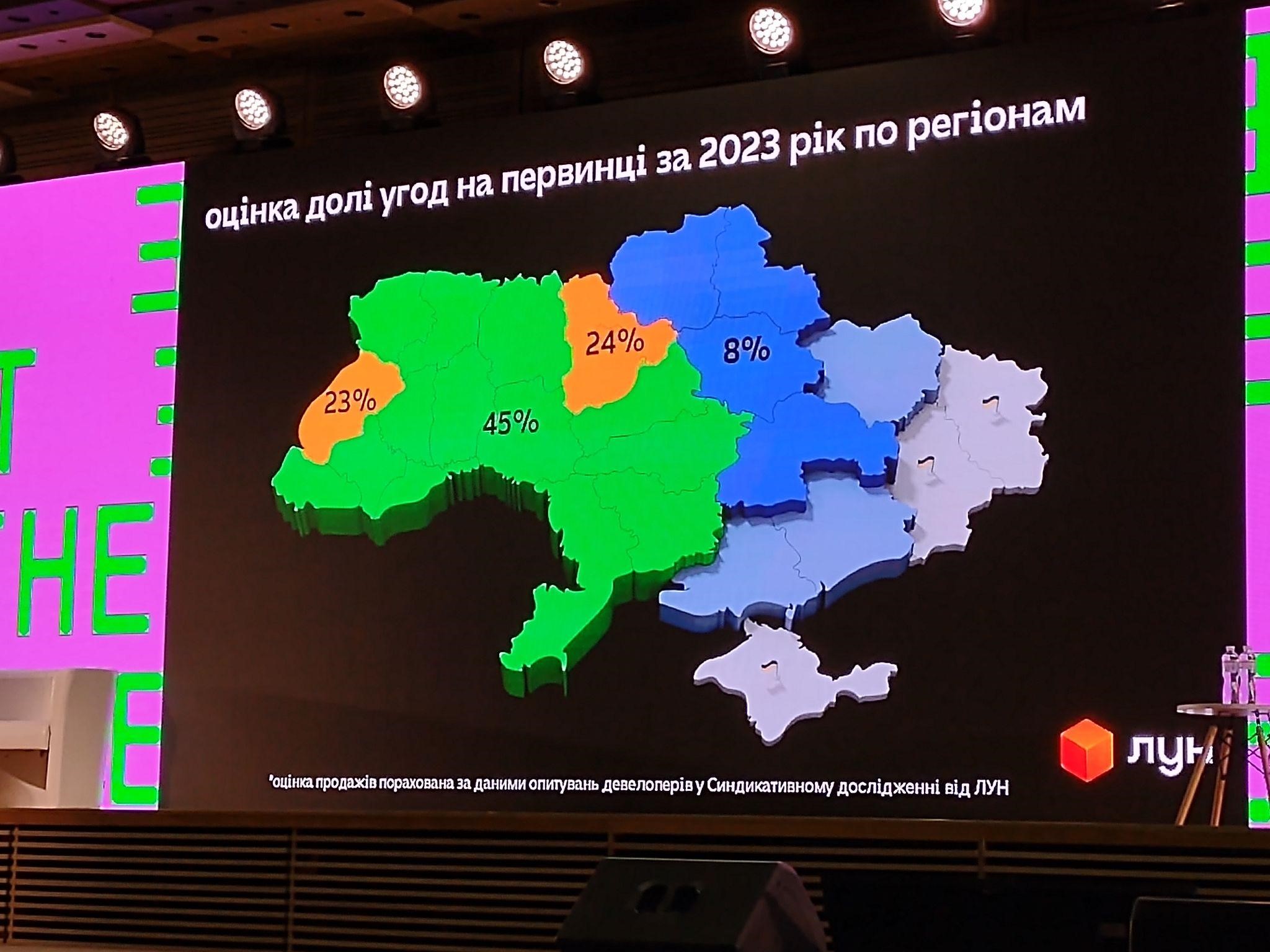

Of all apartment sales in 2023, 45% were in right-bank Ukraine, excluding Kyiv and Lviv regions. Left-bank Ukraine accounted for 8%.

"There are significantly fewer open sales departments on the left bank, so the percentage of sales is also much smaller," said the sales director at LUN.

Overall, 2023 demonstrates recovery in all segments: sales, construction, demand, bringing hope and satisfaction, Olha Okhrimenko concluded during her speech at the Ukrainian Construction Congress.

By the way, LUN, the NGO "Dostupno," and Urban Visionaries of the Taras Shevchenko University Geography Faculty introduced a checklist for accessibility: a brief questionnaire containing all the essential data on housing convenience and accessibility. LUN encourages developers, builders, and all those concerned to participate in filling it out to help as many people as possible find suitable housing.

As a reminder, Rubryka recently reported on who is currently buying homes and whether they are right in doing so.