Rada launches a special regime in IT market

The Verkhovna Rada passed a draft law "On Amendments to the Tax Code to Stimulate the Development of the Digital Economy in Ukraine," which regulates the tax conditions of the special legal regime, Diia City.

285 people's deputies voted for the document.

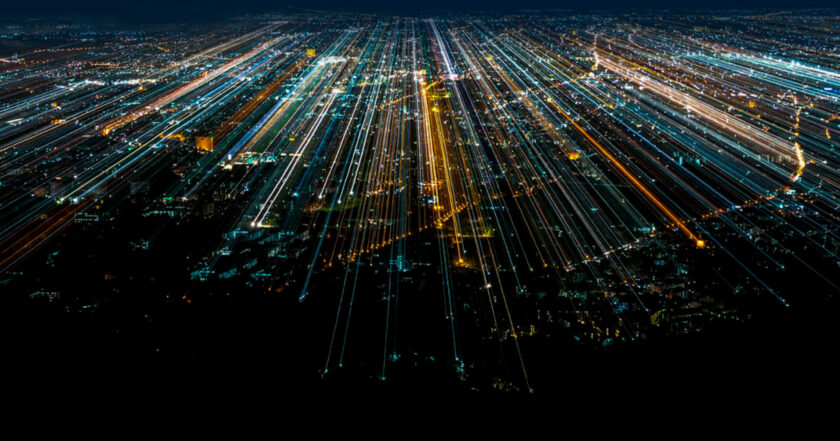

The document provides for introducing a special tax regime for the IT industry, a special model of income taxation of IT workers, and the possibility of choosing a contractual form of the employment contract during the registration of employment relationships in IT companies.

The law specifies the criteria by which IT companies will be able to obtain residency in Diia.City. Thus, a resident of Diia.City may be a legal entity registered in the manner prescribed by law, regardless of its location and place of business, which also meets the following requirements:

it carries out exclusively types of activity of the IT industry;

the average monthly salary of the company's employees is 1,200 euros;

the average number of its employees and gig specialists (in case of involvement) at the end of each calendar month is not less than 9 people;

the amount of the qualifying income received during the first three months of becoming a resident of Diia.City is not less than 90% of the amount of the total income for this period, and the amount of the qualified income received for each calendar year of residence as a resident of Diia.City, is not less than 90% of the amount of its total income for the same period (if there is total income).