An increase in excise duties on tobacco products increased State Budget revenues

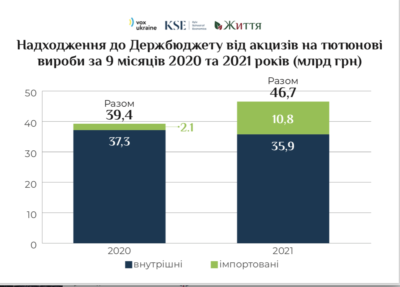

According to the State Treasury, the budget revenues of Ukraine from excises on tobacco products amounted to UAH 46.7 billion in the first 9 months of 2021, which is 18.7% or UAH 7.3 billion more than in the same period in 2020.

Ukraine has managed to achieve such results thanks to introducing an effective policy of increasing excise duties on tobacco products, the NGO "Zhyttia" reports.

In January 2021, amendments to the Tax Code of Ukraine came into force, which harmonized the rates of tobacco excise duties for cigarettes, cigarillos, and heated tobacco products (HTPs). According to these norms, the rate of specific excise duty on HTPs became equal to the minimum excise tax liability of cigarettes, namely 1456 hryvnias per 1000 pieces.

Photo: center-life.org

In the future, rates will increase annually per the "7-year plan" of the annual increase in excise duty by 20%. It is planned to reach the level of 3020 hryvnias in 2025.

"The decision introduced by the Parliament to harmonize excise duties on HTPs and cigarillos to the level of regular cigarettes brought the State Budget an additional UAH 8.5 billion for the first 9 months of 2021 compared to the same period last year. Thus, the expediency of the adopted policy provided by Law 466-IX, and in particular, its economic efficiency, was proved," Danylo Hetmantsev, Chairperson of the Verkhovna Rada Committee on Finance, Tax and Customs Policy, emphasized.

The reason for the decrease in the prevalence of cigarette consumption was the decrease in the affordability of cigarettes because of the increase in excise duty from UAH 1.3 per piece in 2020 to UAH 1.46 per piece in 2021, as well as the general trend of decreasing cigarette consumption, switching to HTPs and e-cigarettes, and an increase in the share of the illegal cigarette trade.

"It all starts at 14," or what to do with teen smoking

They die early: how Ukrainian laws (do not) help prevent smoking

Banning smoking in Ukraine? What does and doesn't a new anti-tobacco draft law have?

Sell, if you can: how banned tobacco advertising works in Ukraine